NECS (the national Electronic Conveyancing System) has a pretty big task ahead of itself. The focus has shifted from a Victorian based electronic lodgment and financial settlement system to a national system. NECS has to bring together and align the interests of all land registries; financial institutions (FIs); lawyers and conveyancers; state revenue collectors; certificate brokers; local councils and water board; and even the Reserve Bank. No small outcome. However a national approach is essential.

Without a single national approach you would be duplicating the current 8 states’ and territories’ physical settlements with 16. This is OK for lawyers and conveyancers who only act locally but not for FIs. The FIs certainly support and would have been the prime advocates for the single national system.

A few singular observations:

1) If you are acting for a client, either a vendor or a purchaser, how do you know if the transaction will be paper or EC?

2) Why should we hand over consideration for title and an executed transfer & discharge of mortgage without knowing if the documentation will be registered or defeated by caveat, fraud or requisition?

3) Under EC the parties create an Electronic Lodgment File (ELF) to transfer the freehold interest from the Registered Proprietor to the Transferee. I presume the same ELF creates the mortgagee interest. What paper documentation supports the transaction?

Sunday, February 26, 2006

Which is it? NECS or paper / physical settlement

It is unclear which party is going to initiate the process. The current NZ experience is 1/20 is performed electronically. 19/20 are still paper / physical settlements. This is frustrating to parties that wish to transact electronically. Lawyers / Conveyancers that wish to transact electronically can be hamstrung by those who unfortunately are the majority who will not change.

I suggest:

A. The Vendor Lawyer contracts as a special condition:

(a) the Vendor will meet the cost of EC; and if the Purchaser elects otherwise

(b) The Purchaser will meet the costs of all parties to attend physical settlement

B. Registration Fees – Give a discount of 10 – 50% on registration fees if EC applies and the full tote is applied to lodgments that are done over the counter. Ditto for stamp duty.

I suggest:

A. The Vendor Lawyer contracts as a special condition:

(a) the Vendor will meet the cost of EC; and if the Purchaser elects otherwise

(b) The Purchaser will meet the costs of all parties to attend physical settlement

B. Registration Fees – Give a discount of 10 – 50% on registration fees if EC applies and the full tote is applied to lodgments that are done over the counter. Ditto for stamp duty.

Registered vs Registrable Interest

Our current system on the face of it seems to work (but could it be made to work better). In some overseas jurisdictions registration occurs first then the funds are handed over. This makes sense. Purchasers once they and their FI has handed over clear funds, receive title and transfer and discharge of mortgage supposedly in registrable form. But the Purchaser is still at risk until registration ultimately occurs. Despite final searches, caveats by third parties can still be lodged. Fraud can defeat a Purchaser. Requisitions can be raised. Transfers are sometimes not lodged. Think Grove Conveyancing. There is still an element of uncertainty until registration is effected. And the practice of lodging caveats seems to have waned.

How could it be done better?

NECS. Could a two stage settlement be the preferred model? NECS is proposing a concurrent system of electronic registration of the ELF and simultaneous financial settlement. This in a way is emulating the current system but probably more certainty that registration occurs contemporaneously with transfer of funds. What about separating the registration and financial settlement?

(a) Electronic lodgment takes place 1 day or 2 days prior to financial settlement. Registration occurs “in escrow”. Like a decree nisi

(b) Upon notice of registration, you have financial settlement, either by EFT or bank cheques are handed over. Registration becomes complete. Decree absolute.

This 2 stage settlement process would perhaps allow more complex conveyancing transactions to take place and create a more flexible hybrid system to evolve.

How could it be done better?

NECS. Could a two stage settlement be the preferred model? NECS is proposing a concurrent system of electronic registration of the ELF and simultaneous financial settlement. This in a way is emulating the current system but probably more certainty that registration occurs contemporaneously with transfer of funds. What about separating the registration and financial settlement?

(a) Electronic lodgment takes place 1 day or 2 days prior to financial settlement. Registration occurs “in escrow”. Like a decree nisi

(b) Upon notice of registration, you have financial settlement, either by EFT or bank cheques are handed over. Registration becomes complete. Decree absolute.

This 2 stage settlement process would perhaps allow more complex conveyancing transactions to take place and create a more flexible hybrid system to evolve.

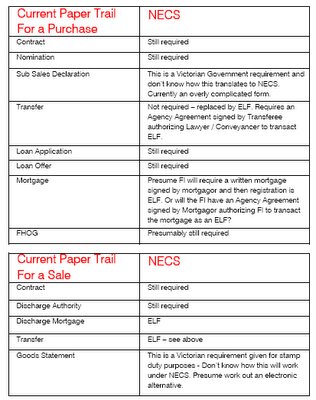

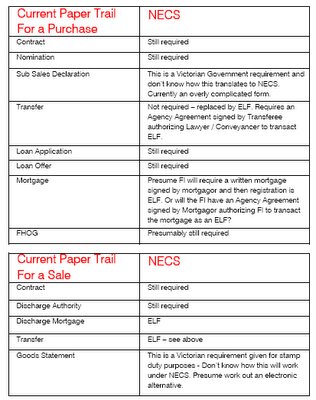

NECS and the Paper Trail

What paper is or won’t be needed under NECS? There has been very little published on the nuts and bolts of EC or NECS. I am therefore looking a little ahead of time and trying to see what practical differences there will be between the two systems from the critical documentation trail that currently exists. Click on image to enlarge.

Saturday, February 25, 2006

First Title Insurance - defence against fraud

When anyone falls victim to real estate fraud, even though it might not be that common, the size of the fraud always has a much greater impact than say credit card fraud. The statistics from Canada suggest the average loss on real estate fraud is $300,000 in comparison with the average loss on credit card fraud is $1200.

A recent press release from Canadian First Title Insurance gves an interesting insight to some systematic real estate fraud involving Vancouver lawyer Martin Wirick.

After four years of investigations, recently approved $32.5 million in payments to cover a multimillion-dollar real estate fraud case The high-profile case involved transactions between 1998 and 2002 and affected hundreds of victims in the scheme.

I personally am looking to systematically recommend clients purchase a title insurance policy. If anything such advice protects me.

A recent press release from Canadian First Title Insurance gves an interesting insight to some systematic real estate fraud involving Vancouver lawyer Martin Wirick.

After four years of investigations, recently approved $32.5 million in payments to cover a multimillion-dollar real estate fraud case The high-profile case involved transactions between 1998 and 2002 and affected hundreds of victims in the scheme.

I personally am looking to systematically recommend clients purchase a title insurance policy. If anything such advice protects me.

Mirvac triumphs in misrepresentation case

Mirvac scores a victory in the misrepesentation case brought against them by Jerrard & Stuk acting for investor Joseph Peter La Rocca.

The Age reported:

Mr La Rocca claimed Mirvac's agent, Margaret McBride, had made representations that the apartment would be on the 16th floor, would have uninterrupted views of Port Phillip Bay, would double in value in five years and could be rented for $2000 a week.

He claimed that none of these conditions had been met and his off-the-plan contract did not comply with the Domestic Building Contracts Act, which made the contract void.

The heated Supreme Court dispute included a witness statement lodged by Mirvac sales manager Graham Katz that alleged Mr La Rocca had said: "I have $30,000 in the bank, I'd rather pay them (his lawyers) than you. I've been to court and the best liars win."

Yesterday, Justice Hargrave described the contract of sale as "just, fair and reasonable", before ordering Mr La Rocca to pay a $96,000 deposit, plus interest and legal costs, which could total almost $500,000.

In his ruling, Justice Hargrave dismissed all claims that Mr La Rocca had been induced into the contract by misrepresentations or that Mirvac had acted unconscionably.

The case had challenged the enforcement of off-the-plan contracts and threatened a flurry of legal action by dissatisfied apartment investors.

My observation that I made earlier is that this case and any case for that matter came down to the facts and the quality of the witnesses, evidence and corroboration of the evidence. Mr Rocca was very well represented. It would appear, however, Mr Rocca did not make the best witness. Misrepresentation is always difficult to prove as you are moving outside the boundaries of the Contract. The case certainly stands for one thing and that is it validates off-the-plan contracts in Victoria.

A paragraph lifted from the judgement

"The defendant was a most unsatisfactory witness. He is not unintelligent and clearly has a reasonable degree of business acumen. From my observation of him, he well understood the factual issues about which he was giving evidence. Notwithstanding these matters, the defendant gave inconsistent evidence on important issues, was evasive when challenged with these inconsistencies, was argumentative and prone to speculation and reconstruction. At times, he gave definite evidence that things did not happen when it was clear he had no recollection at all about the subject matter of the questioning. As appears hereafter, he admitted misleading Mr Katz in conversations with him. On occasions, his instructions to his lawyers were plainly false, and he could not justify them upon cross-examination. Finally, as will appear, I am satisfied that the defendant set out to mislead the Court as to the extent of his knowledge of a letter to the plaintiff which was signed by him, but which he says was written by his wife, as to the circumstances of him signing that letter and as to the reason why his wife did not give evidence at the trial".

The Age reported:

Mr La Rocca claimed Mirvac's agent, Margaret McBride, had made representations that the apartment would be on the 16th floor, would have uninterrupted views of Port Phillip Bay, would double in value in five years and could be rented for $2000 a week.

He claimed that none of these conditions had been met and his off-the-plan contract did not comply with the Domestic Building Contracts Act, which made the contract void.

The heated Supreme Court dispute included a witness statement lodged by Mirvac sales manager Graham Katz that alleged Mr La Rocca had said: "I have $30,000 in the bank, I'd rather pay them (his lawyers) than you. I've been to court and the best liars win."

Yesterday, Justice Hargrave described the contract of sale as "just, fair and reasonable", before ordering Mr La Rocca to pay a $96,000 deposit, plus interest and legal costs, which could total almost $500,000.

In his ruling, Justice Hargrave dismissed all claims that Mr La Rocca had been induced into the contract by misrepresentations or that Mirvac had acted unconscionably.

The case had challenged the enforcement of off-the-plan contracts and threatened a flurry of legal action by dissatisfied apartment investors.

My observation that I made earlier is that this case and any case for that matter came down to the facts and the quality of the witnesses, evidence and corroboration of the evidence. Mr Rocca was very well represented. It would appear, however, Mr Rocca did not make the best witness. Misrepresentation is always difficult to prove as you are moving outside the boundaries of the Contract. The case certainly stands for one thing and that is it validates off-the-plan contracts in Victoria.

A paragraph lifted from the judgement

"The defendant was a most unsatisfactory witness. He is not unintelligent and clearly has a reasonable degree of business acumen. From my observation of him, he well understood the factual issues about which he was giving evidence. Notwithstanding these matters, the defendant gave inconsistent evidence on important issues, was evasive when challenged with these inconsistencies, was argumentative and prone to speculation and reconstruction. At times, he gave definite evidence that things did not happen when it was clear he had no recollection at all about the subject matter of the questioning. As appears hereafter, he admitted misleading Mr Katz in conversations with him. On occasions, his instructions to his lawyers were plainly false, and he could not justify them upon cross-examination. Finally, as will appear, I am satisfied that the defendant set out to mislead the Court as to the extent of his knowledge of a letter to the plaintiff which was signed by him, but which he says was written by his wife, as to the circumstances of him signing that letter and as to the reason why his wife did not give evidence at the trial".

Saturday, February 18, 2006

NZ e-dealing reports major outage

The NZ e-dealing system reported a major outage. Landonline was out of commission 30 November until the morning of 2 December 2005.

The disk failure at the "back end" which caused Landonline to be out of commission from 30 November until the morning of 2 December resulted from a disk microcode problem that affected the movement of data between the databases, their associated server processors and the storage area network hardware. Microcode, which is sometimes called firmware, is in almost every modern electronic device we use – it is not specific to the Landonline system. Our software and hardware suppliers have fixed the problem and fully analysed and reported the cause to management. They are of the very firm view the chances of this type of event re-occurring are extremely remote.

The full report

The disk failure at the "back end" which caused Landonline to be out of commission from 30 November until the morning of 2 December resulted from a disk microcode problem that affected the movement of data between the databases, their associated server processors and the storage area network hardware. Microcode, which is sometimes called firmware, is in almost every modern electronic device we use – it is not specific to the Landonline system. Our software and hardware suppliers have fixed the problem and fully analysed and reported the cause to management. They are of the very firm view the chances of this type of event re-occurring are extremely remote.

The full report

Thursday, February 16, 2006

UK electronic conveyancing 2009

It looks like UK and Australia are in step with the government land registries introducing electronic conveyancing.

Australia's national e-convyancing project is focused on settlements, electronic lodgment of dealings such as transfers &mortgages and the simultaneous online transfer of settlement funds.

A brief description in a UK release is "all conveyancing for people buying and selling property in England and Wales could be carried out electronically by 2009. Under the new system solicitors will no longer have to send paper documents, such as contracts, to each other through the post, but will be able to transfer them instantly electronically".

This sounds a bit like the UK system may bit a bit more embrasive if it includes electronic contracts. The Australian system specifically does not include the contractual phase.

Parliamentary Under Secretary of State for Constitutional Affairs Baroness Ashton of Upholland said in a written statement to the Lords that electronic conveyancing could be made compulsory in England and Wales by 2009 or 2010.

A prototype of the system is being tested by solicitors in Portsmouth and Bristol this year, and a wider pilot scheme will be carried out during the second half of 2007.

The latest UK programme milestones. E-Conveyancing at a glance

Australia's timetable is much the same.

Australia's national e-convyancing project is focused on settlements, electronic lodgment of dealings such as transfers &mortgages and the simultaneous online transfer of settlement funds.

A brief description in a UK release is "all conveyancing for people buying and selling property in England and Wales could be carried out electronically by 2009. Under the new system solicitors will no longer have to send paper documents, such as contracts, to each other through the post, but will be able to transfer them instantly electronically".

This sounds a bit like the UK system may bit a bit more embrasive if it includes electronic contracts. The Australian system specifically does not include the contractual phase.

Parliamentary Under Secretary of State for Constitutional Affairs Baroness Ashton of Upholland said in a written statement to the Lords that electronic conveyancing could be made compulsory in England and Wales by 2009 or 2010.

A prototype of the system is being tested by solicitors in Portsmouth and Bristol this year, and a wider pilot scheme will be carried out during the second half of 2007.

The latest UK programme milestones. E-Conveyancing at a glance

Australia's timetable is much the same.

Tuesday, February 14, 2006

Boardroom Auction settles business partners’ dispute

Not exactly conveyancing, however it is interesting to report on how two partners in business for 10 years, which turned over $2M, settled their irreconcilable differences by bidding for the other’s 50% share in a board room auction.

Via the accountant, these partners had for over 4 years being trying to sort out their problems but nothing was really working and neither talking to the other that much. Probably sounds familiar to a lot of people.

When I was engaged last November, my client made it clear to me he had hit the end of the road (as far as he was concerned the partnership was finished). The problem was the other partner still wanted to maintain the status quo despite the deep seated issues.

My summation was that this was going to either end in tears or the business partnership was terminated by one party buying the other party’s share. I made it clear upfront I was not interested in acting if this was going to end in court and protracted litigation or just as worse appointing an administrator.

Interestingly, the best negotiations take place around the table. It avoids the endless rounds of exchange of letters, each side trying to point score.

After a couple of stalled moments, a Heads of Agreement was reached, each side had arranged their finance and the parties were in the position to seriously focus on the moment of truth and face each other in a board room auction. The parties themselves determined the auction rules.

1. The Heads of Agreement was signed before the auction began

2. No bid was to be less than $20,000

3. Each party could take at any time a 5 minute break to consider their next bid

4. A 20% deposit to be paid

5. There were very extremely serious penalties for the winning bidder if they defaulted.

I must say there is a certain thrill in witnessing such events, bidding tactics only reveals themselves as each bid is made and the outcome was completely unpredictable. I think I could warm to becoming an auctioneer.

Via the accountant, these partners had for over 4 years being trying to sort out their problems but nothing was really working and neither talking to the other that much. Probably sounds familiar to a lot of people.

When I was engaged last November, my client made it clear to me he had hit the end of the road (as far as he was concerned the partnership was finished). The problem was the other partner still wanted to maintain the status quo despite the deep seated issues.

My summation was that this was going to either end in tears or the business partnership was terminated by one party buying the other party’s share. I made it clear upfront I was not interested in acting if this was going to end in court and protracted litigation or just as worse appointing an administrator.

Interestingly, the best negotiations take place around the table. It avoids the endless rounds of exchange of letters, each side trying to point score.

After a couple of stalled moments, a Heads of Agreement was reached, each side had arranged their finance and the parties were in the position to seriously focus on the moment of truth and face each other in a board room auction. The parties themselves determined the auction rules.

1. The Heads of Agreement was signed before the auction began

2. No bid was to be less than $20,000

3. Each party could take at any time a 5 minute break to consider their next bid

4. A 20% deposit to be paid

5. There were very extremely serious penalties for the winning bidder if they defaulted.

I must say there is a certain thrill in witnessing such events, bidding tactics only reveals themselves as each bid is made and the outcome was completely unpredictable. I think I could warm to becoming an auctioneer.

Friday, February 10, 2006

internet marketing

According to a recent New York Times article the Web is already displacing the initial contact that agents have with customers. To quote "A recent National Association of Realtors survey found that 77 percent of home buyers use the Internet to search for a home".

Speaking to some local estate agents their internal figures show the Internet and the Board account for 62% of inquiry. The net is proving to be the first and foremost effective and cost efficient form of advertising and marketing. No surprise there.

A vendor needs quality photography and floor plans which forms the basis of the advertising campaign. Photos and floor plans can be used and re-used in the campaign: the internet, the board, the agent's window, the flyers, the company magazine.

What makes up the other 38% of inquiry? You could say the Classifieds like the Age or local paper advertising. The problem with the Classifieds is it's the most expensive and possibly the least effective. The Classifieds may only account for 10% inquiry but it eats up a substantial part of any advertising budget. Another drawback is The Age or SMH are too widespread and you don't get much bang for your buck. Think about it - most residential buyers are locals, buying and selling local. They may be upgrading. It is not that infrequent you hear the neighbour buys the house next door. Or the buyer is shifting to a more affluent suburb but in the same locale. So the local paper is probably more effective.

Personally, I think the 38% is by careful selection of your selling agent in the local area. How do you select the right agent? Difficult question. I'm just a solicitor. It certainly doesn't hurt to follow a recommendation or referral.

Three websites mentioned in the NYT article

Zillow.com

Redfin.com

PropertyShark.com

These 3 sites are all worthy of seeing future directions in real estate marketing

Speaking to some local estate agents their internal figures show the Internet and the Board account for 62% of inquiry. The net is proving to be the first and foremost effective and cost efficient form of advertising and marketing. No surprise there.

A vendor needs quality photography and floor plans which forms the basis of the advertising campaign. Photos and floor plans can be used and re-used in the campaign: the internet, the board, the agent's window, the flyers, the company magazine.

What makes up the other 38% of inquiry? You could say the Classifieds like the Age or local paper advertising. The problem with the Classifieds is it's the most expensive and possibly the least effective. The Classifieds may only account for 10% inquiry but it eats up a substantial part of any advertising budget. Another drawback is The Age or SMH are too widespread and you don't get much bang for your buck. Think about it - most residential buyers are locals, buying and selling local. They may be upgrading. It is not that infrequent you hear the neighbour buys the house next door. Or the buyer is shifting to a more affluent suburb but in the same locale. So the local paper is probably more effective.

Personally, I think the 38% is by careful selection of your selling agent in the local area. How do you select the right agent? Difficult question. I'm just a solicitor. It certainly doesn't hurt to follow a recommendation or referral.

Three websites mentioned in the NYT article

Zillow.com

Redfin.com

PropertyShark.com

These 3 sites are all worthy of seeing future directions in real estate marketing

Wednesday, February 08, 2006

Does digital conveyancing work?

| Month | New files | Month | New files |

| Aug 04 | 20 | Aug 05 | 50 |

| Sep 04 | 12 | Sep 05 | 52 |

| Oct 04 | 15 | Oct 05 | 51 |

| Nov 04 | 25 | Nov 05 | 52 |

| Dec 04 | 17 | Dec 05 | 30 |

| Jan 05 | 17 | Jan 06 | 53 |

The above table records the comparison of new files opened by my legal firm (sole practitioner) comparing monthly figures. Some months there has been a 100% increase in new files, others 4 times, recently 3 times. But at all times there has been a significant increase in new files opened, as a direct response to using and promoting digital conveyancing.

Conveyancers target Sunshine State

AFTER breaking open the conveyancing market in Victoria, the nation's non-lawyer conveyancers are turning their sights on Queensland - the last state in which solicitors enjoy a statutory monopoly on property transfers.

Coveyancers are planning a national summit to prepare their tactics for a renewed assault on the Queensland market.

After Victoria's decision last week to open the conveyancing market to full competition, Australian Institute of Conveyancers national president Terry Allen called on the Queensland Government to fall into line with the rest of the nation. He said conveyancers from around the nation had been planning to meet in Melbourne on February 18, but after the Victorian breakthrough, Queensland would be high on the agenda.

The Australian January 2006

Coveyancers are planning a national summit to prepare their tactics for a renewed assault on the Queensland market.

After Victoria's decision last week to open the conveyancing market to full competition, Australian Institute of Conveyancers national president Terry Allen called on the Queensland Government to fall into line with the rest of the nation. He said conveyancers from around the nation had been planning to meet in Melbourne on February 18, but after the Victorian breakthrough, Queensland would be high on the agenda.

The Australian January 2006

Sunday, February 05, 2006

300% inrease in turnover

247legal.com.au has established online business methodologies for delivering contract and vendor statements digitally. My law firm Hayton Kosky is the trial guinea pig for testing the effectiveness of the system. I have been trialing the vendor disclosure module for the last 12 months. The last 6 months it has really hit home the effectiveness, the efficiencies and acceptance of the model by estate agents, clients and my legal staff. Every month for the last 6 months I have been setting new records for new business and this is essentially based on referrals from estate agents that have embraced the 247 system.

This January (2006) there was a 300% increase in business (new files opened) over January 2005. There has been a consistent increase in files opened. The volume of files is only a pinprick, but they form the blueprint for other lawyers and conveyancers to follow. See comparative table above.

The 247 system will be ready for launch for lawyers and conveyancers following some critical development with GXS / GlobalX, feedback from members and some further testing.

This January (2006) there was a 300% increase in business (new files opened) over January 2005. There has been a consistent increase in files opened. The volume of files is only a pinprick, but they form the blueprint for other lawyers and conveyancers to follow. See comparative table above.

The 247 system will be ready for launch for lawyers and conveyancers following some critical development with GXS / GlobalX, feedback from members and some further testing.

Subscribe to:

Posts (Atom)